…And beyondīesides Axie Infinity, CryptoKitties is another play-to-earn game that has built up a substantial following. It is the largest gaming cryptocurrency on the market. AXS has also seen an impressive rise recently, up about sixfold in recent weeks. Investors in AXS have a vote in the governance of the game’s ecosystem, and can also use it to get a share of the community treasury. Monthly trading volumes for all Axie Infinity NFTs currently stand at US$170 million.įinally, there is another cryptocurrency associated with this game called the Axie Infinity shard (AXS). Meanwhile, a chunk of in-game real estate went for US$1.5 million earlier in 2021.

The most expensive ever Axie, a triple mystic called Angel, sold for ETH300 in late 2020, which was around US$120,000 at the time. They are available from US$190 (£138), though theĬurrent average is about US$350, and higher level, rare or mystic Axies can sell for a lot more. To get started on Axie Infinity, players need to buy ( or borrow) three Axies.

By introducing a dedicated marketplace, NFTs and a blockchain, the trading around Axie Infinity and similar games is more secure and means that players actually own the items in question. This is a welcome improvement on predecessors such as World of Warcraft where trading of gold and in-game assets took place in unaffiliated auction sites, and was grounds for being banned from the game for a long time. These are all bought and sold using ethereum, which is the second biggest cryptocurrency after bitcoin. NFTs are digital collectables that exist on online ledgers known as blockchains, and are better known for recently taking the art world by storm.Īs well as Axies, other in-game items like real estate, flowers, barrels and lamps are all tradeable as NFTs too. It has broadly been rising since 2020, so there is an argument for hanging on to them – or alternatively, selling while the going is good.Īxies themselves can be traded in real life in the likes of the Axie Marketplace as NFTs (non-fungible tokens). Top players are reportedly earning SLP1,500 (US$435/£317) per day from their Axies, though the price of SLPs against the US dollar is constantly changing. SLPs double as cryptocurrencies that can be bought and sold on a crypto exchange. The object of the game is to obtain small love potions (SLPs), which can be used to breed new Axies that can then be deployed within the game. The game revolves around cute furry creatures called Axies, which players breed, acquire, train, use to complete challenges, and do battle with online. It has some 350,000 daily active users, about 40% of whom are in the Philippines, with Venezuela and the US the next two biggest markets. The leader in this new space is Axie Infinity, a Pokémon-style game created by the Vietnamese developer Sky Mavis. So how do these games work and where are they heading? To infinity … But play-to-earn games take this to a whole new level. There have also been games like World of Warcraft where a grey market for exchanging in-game items and characters grew up around them.

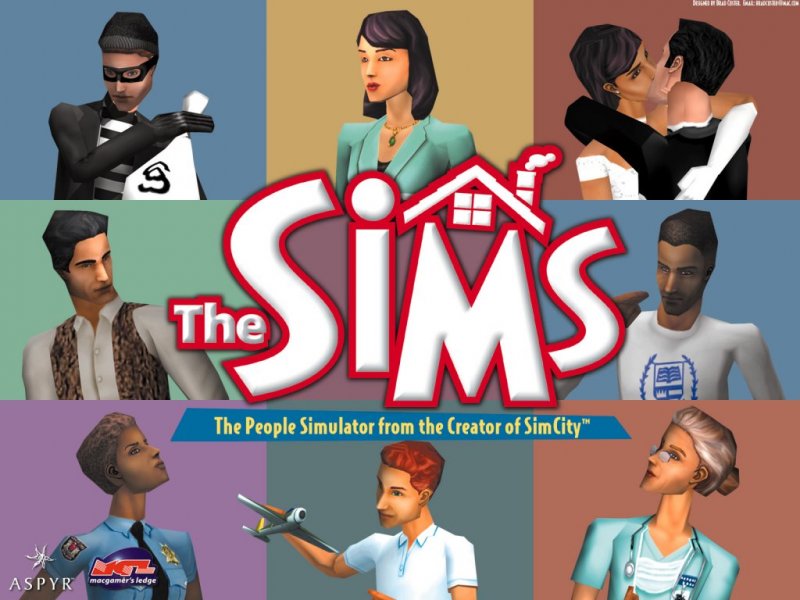

Or in life-simulation franchise The Sims, players buy everything from pizzas to houses with Simoleons.īut in these older games, the in-game currency had no value in the real world. In the 1980s blockbuster Elite, for example, players travelled from planet to planet, trying to increase their credits by buying and selling things like weapons and commodities.

What they have in common with many previous classics is that they include complex economic ecosystems. So-called play-to-earn games like Axie Infinity and The Sandbox have been exploding in popularity recently. Whether it’s Space Invaders or Sonic or Red Dead Redemption, you hit the start button and do your thing until game over – and then you probably wipe the sweat off your hands and do it again.īut a new class of games is emerging where playing is an investment opportunity – and even potentially a way to earn a living. The ultimate point of playing video games has always been to have fun.

0 kommentar(er)

0 kommentar(er)